Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

Select Language

I. Development of China's financial IC card specification

Financial IC cards are financial payment instruments that use integrated circuit (IC) technology and financial industry standards, and have functions such as consumer credit, transfer settlement, and cash access. Since its introduction in France in the mid-1980s, financial IC cards have been gradually applied to social and economic activities. China's financial IC card work started earlier. In 1997, the People's Bank of China formulated and promulgated the "China Financial Integrated Circuit (IC) Card Specification" (V1.0) - PBOC1.0, and organized a joint pilot. The promulgation and implementation of PBOC1.0 marks the era when China's financial IC cards begin to enter a unified standard, laying the foundation for the establishment of a national unified IC card technology system. In March 2005, in response to the international EMV migration, the People's Bank of China promulgated the "China Financial Integrated Circuit (IC) Card Specification" (2005 version) - PBOC2.0.

The PBOC 2.0 specification extends from the PBOC 1.0 e-wallet/electronic passbook function to the debit/credit application, and initially defines the non-contact development technology route unrelated to the application. The promulgation of PBOC2.0 is a smooth transition for the magnetic stripe card. Providing a technical solution to the financial IC card has also become a necessary prerequisite for the terminal to carry out the transformation and prepare for acceptance. In May 2010, according to the feedback of the Ningbo financial IC card multi-application pilot, in order to further meet the needs of the fast-moving and small-scale payment of the public, the People's Bank of China promulgated and implemented the 2010 version of the PBOC 2.0 specification, which is in full compliance with the original debit. Based on the /credit application, it supports the contactless application and micropayment application.

Second, PBOC3.0 upgrade background

On March 15, 2011, the People's Bank of China issued the "Opinions on Promoting the Application of Financial IC Cards" (hereinafter referred to as "Opinions"), and decided to officially launch the bank card chip migration work nationwide. During the "Twelfth Five-Year Plan" period Promote the application of financial IC cards in an all-round way. Since the launch of the financial IC card application, the tasks have developed very well: all ATMs and POS terminals can accept financial IC cards. By the end of 2012, the country has issued a total of 126 million financial IC cards, and financial IC cards are in public service. Applications in the field have been rapidly promoted, and various new applications and new demands based on financial IC cards have emerged. In order to fully support the application of financial IC cards in the public service field and adapt to the current multi-domain application requirements of financial IC cards, the People's Bank of China started the third PBOC specification upgrade in 2012. The PBOC specification upgrade is mainly to meet the following three requirements.

The first is industry expansion. Adapt to the industry demand for electronic cash-sharing, segmented billing payment methods, and electronic cash freezing in the public service sector, and promote the application of financial IC cards in public service such as high-speed rail, bus, and subway.

The second is innovative payment. Realize the integration of financial IC card applications with innovative applications such as Internet payment and mobile payment, and promote online channel integration.

The third is cross-border use. Meet the needs of Chinese cardholders, especially in Hong Kong and Macao, using financial IC cards for electronic cash payments.

Third, the main content of PBOC3.0

(1) The main content of the 2010 edition of the PBOC 2.0 specification

The 2010 edition of the PBOC 2.0 specification consists of 13 parts:

The e-wallet/electronic passbook application defined in Parts 1 and 2 is revised and improved on the basis of the PBOC 1.0 specification, and together with the 9th part of the e-wallet extension application constitutes the e-wallet/electronic passbook application specification;

The third part is a contact interface mainly based on the ISO/IEC 7816 standard and with reference to international standards such as ISO 3166, ISO 639, ISO 9362, ISO 13616, ISO 7811, ISO/IEC 10373 and ISO/IEC 8859. Can be combined with an e-wallet/electronic passbook or debit/credit application to form an e-wallet/electronic passbook or debit/credit application with a contact interface;

Sections 4 through 7 form the debit/credit application, which mainly refers to the EMV standard and refers to ISO/IEC 7816, ISO 3166, ISO/IEC 639, ISO 4217, ISO 9564, ISO 8583, ISO. Developed in accordance with international standards such as 13491, ISO 8731, ISO 8732, ISO/IEC 9796, ISO/IEC 9797, ISO/IEC 10116 and ISO/IEC 8859;

Part 8 is a non-contact interface specification developed by the NEQ standard ISO14443 standard. This part defines an application-independent contactless interface that can be combined with an e-wallet/electronic passbook or debit/credit application. Electronic wallet/electronic passbook or debit/credit application with contactless interface;

Part 10 is based on the EMV General Personalization Specification, which defines the process of personalization of debit/credit applications, as well as data formats and groupings, and standardizes the personalization process;

Part 11 is based on Section 8 and specifies the requirements for wireless communication protocols between contactless devices and contactless cards;

Part 12, together with Part 8 and Part 11, constitutes a contactless application that primarily defines financial payment applications based on contactless interfaces;

Part 13 together with Sections 4 through 7 constitutes a debit/credit based micropayment application that primarily defines the content related to micropayments, ie the technical realization of micropayments and the types of transactions supported. .

(2) Main contents of PBOC3.0 upgrade

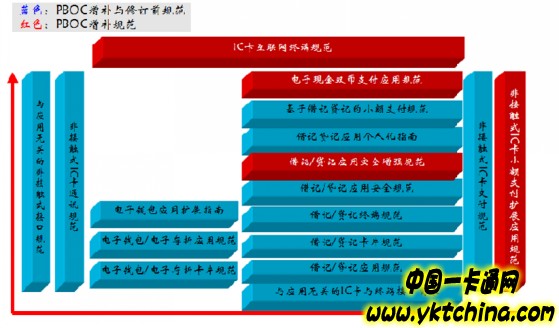

The PBOC 3.0 specification is mainly supplemented and revised on the basis of the 2010 edition of the PBOC 2.0 specification, as shown in the following figure:

Figure 1 Revision of the 2012 Financial IC Card Standard

The PBOC specification addition work is mainly reflected in the following four aspects: First, in order to meet the application requirements of financial IC cards in public service such as public transportation, subway, high-speed rail, etc., the application specification of non-contact IC card micropayments is supplemented; Solve the problem of Chinese cardholders using financial IC cards for payment in Hong Kong and Macao, supplementing the application rules of electronic cash dual-currency payment; third, to meet the application needs of financial IC cards in innovative payment methods such as Internet payment and mobile payment. The offline channel integration has supplemented the IC card Internet terminal specification; the fourth is to supplement the debit/credit application security enhancement specification to ensure the security of financial transactions.

E-mel kepada pembekal ini

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

Fill in more information so that we can get in touch with you faster

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.